I have been chronicling the toppling of the green energy dominoes for quite some time, as people begin to discover that climate cult beliefs in technology is not the same as scientific and engineering realities. Some recent highlights include:

Sweden’s government has ditched plans to go all-in on “green energy,” green-lighting the construction of new nuclear power plants. Fossil fuel giant Shell announced it was scaling back its energy transition plans to focus on . . . gas and oil! Specific wind farm projects began to topple due to strong economic headwinds because the cost of the electricity to be generated was deemed too high.

British Prime Minister Rishi Sunak announced his decision to open the North Sea to more oil and gas drilling. French President Emmanuel Macron is surrendering to reality and asked for a “regulatory pause.”

Now comes the news that investors are fleeing renewable energy funds due to rising costs and escalating rates.

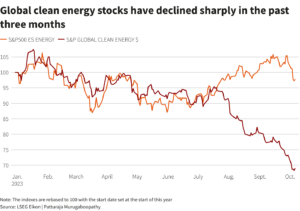

Investors ditched renewable energy funds at the fastest rate on record in the three months to end-September as cleaner energy shares took a beating from higher interest rates and soaring material costs, which are squeezing profit margins.

Renewable energy funds globally suffered a net outflow of $1.4 billion in the July-September quarter, the biggest ever quarterly outflow, according to LSEG Lipper data.

However, the outflows only partially reversed the trend for the first half of 2023 when investors added a net $3.36 billion, the data showed.

The sector’s total assets under management now stand at $65.4 billion, a 23% decline from end-June, according to the data.

It looks like a green energy bloodbath.

Escalating interest rates are a significant contributing factor to this decision.

Renewable energy firms with high growth potential are falling victim to the current economic climate shaped by high interest rates, elevated costs and supply chain issues, with China dominating the solar supply chain, for instance.

Renewable companies often have long-term contracts with a fixed price, while their current borrowing costs are soaring due to high interest rates and raw material is affected by high inflation.

The rise in costs is therefore eating away their profits.

Companies including Denmark’s Orsted, the world’s largest offshore wind farm developer, and US panel maker First Solar have seen sharp share price falls in recent months.

“Renewable energy funds have faced weakened sentiment due to company performances in recent quarters and a shift in investor attention this year towards other themes like AI and US Infrastructure,” said Global X research analyst Madeline Ruid.

Interestingly, six Atlantic shore Governors are begging the federal government to bail them out of a huge looming offshore wind cost overrun (hat-tip Hot Air’s Beege Welborne).

They sent Biden a joint letter asking for a list of relief measures ranging from tax breaks to revenue sharing.

The outcome is far from clear but my guess is the largess is unlikely to appear, especially given the ongoing federal budget battles. Maybe later. However most of the requests also likely require major regulatory changes, which could take years. They might even take legislation which could be never.

But the need is urgent as the offshore developers are demanding immediate power price increases of around 50% lest they leave for better opportunities elsewhere. They can do this because offshore wind is a global boom. Even mid-income developing countries like Indonesia are talking big offshore numbers.

Ironically, it is this boom that is driving some of the sticker-shocking price increases. There is even a shortage of highly specialized crane ships to erect these huge towers. The supply chain is a seller’s market, at least on paper. Rising interest rates are another big driver.

As a reminder that is a wise idea to base investments and infrastructure on real science and practical engineering, here is a information on more highly energy-productive options.

- Coal is a remarkably dense energy source: A single metric ton of coal can produce up to 1,927 kilowatt-hours of electricity. In the United States, 52% of the electricity comes from coal generation. A typical coal fired power plantcan produce 109 kWh/year (1,000,000,000 kWhr/year) of power, the plant burns 14,000 tons of coal every day.

- Nuclear energy takes production up a notch, so the units are in megawatts (1 million watts). As an example of potential capacity, one example reactor operates at 582 MW capacity for 24 hours, and generate 13,968 megawatthours (MWh) during this time. IDuring the year, it would create 5,098,320 MWh.

https://t.co/l1LTwpDGhi pic.twitter.com/BFQjYqmkDH

— Leslie Eastman ☥ (@Mutnodjmet) August 11, 2023

Donations tax deductible

to the full extent allowed by law.