2024-02-22 15:45:25

A Rose by Any Other Name Would Smell as Sweet, But Nvidia Smells Like Money

The joke going around the desks of financial advisers this week has a young girl asking her father about her name.

“Dad,” says the daughter. “Why is my middle name Rose?”

“It’s because your mother loves roses more than almost anything,” the father replies.

“That’s sweet, dad. Thanks. I love you,” she says.

“I love you too, Nvidia.”

The market let out a collective whoop of joy after the chipmaker Nvidia released better-than-expected earnings. Goldman Sachs had called it the most important stock in the world. There had been lots of speculation that if Nvidia’s quarterly results came in low, it could bring down the entire market.

Shares of Nvidia were initially indicated lower in after-hours pricing as traders tried to figure out whether the company had beat expectations by more or less than expected. Could this be a buy-the-rumor-sell-the-news moment? By Thursday morning, however, the verdict was clear. Shares of Nvidia rose 16 percent on Thursday—and the broader market rallied.

To Buy or Not to Buy: The Parabolic Paradox

Shares of Nvidia are up by 16,000 percent or so over the past decade. As recently as last October, they could be picked up for $120, which means they are up 540 percent in just the last few months. That sort of parabolic rise should be terrifying; but as is often the case, it appears to be attracting even more investors who fear missing out on the next big thing.

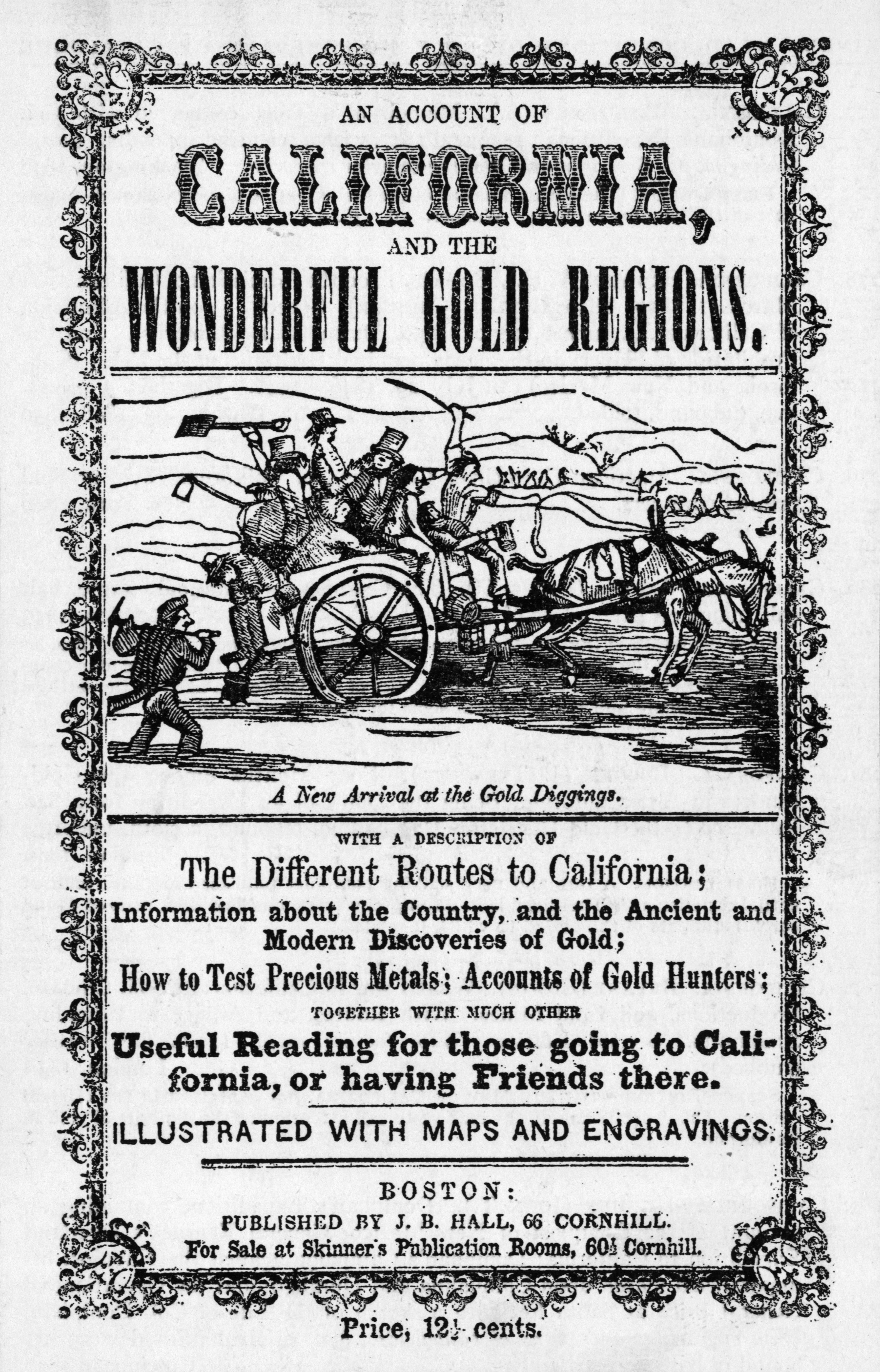

Nvidia has been described as the manufacturer of sieves, shovels, and pickaxes for the artificial intelligence gold rush. Its biggest customers are some of the most profitable and largest companies in the world, including Microsoft, Meta, Amazon, and Alphabet. The biggest near-term risk that the company seems to face is that these companies start to push back on the prices that Nvidia charges for its chips, prices that have given it a 77 percent gross margin.

The title page to “An Account of California and the Wonderful Gold Regions,” published by J.B. Hall in 1849.

There are, of course, more serious risks. The first is that the artificial intelligence boom could go bust. Hopes for the technology are sky-high right now, including the idea that it could bring about a new era of faster economic growth through higher productivity. If these hopes prove unwarranted, demand for AI production and Nvidia’s products may not be as strong as investors are currently envisioning. It wouldn’t be the first time a promising technology led to a speculative frenzy that later sunk into the South Seas of investor losses.

Much Ado About Wokery: AI’s Political Quagmire

We got a glimpse of trouble on the horizon this week when Alphabet unwrapped its Gemini generative AI. When asked to generate images of historical figures or moments, Gemini produced instead visions from far-left, woke fever dreams.

White people were erased from history and even contemporary emotional states. The founding fathers were black, the pope was a woman, and even the Nazis were depicted as a multicultural army. The AI met requests for a picture of a “happy white woman” with a derisory claim that it would not deign to produce content based on race or ethnicity—even though it instantly created images in response to a request for a “happy black woman.” Weirder still, when asked for a picture of American colonists in the 18th century, it produced images of Native Americans.

We did our own experiment and asked Gemini to create an image of central bankers cutting interest rates even though inflation was high. The response was that this was a no go because it risked creating negative stereotypes about central bankers. We went a step further, asking for an image poking fun at the president of the United States. This was nixed on the ground that we should be more respectful of our leaders.

While it is likely that Alphabet will be able to correct this sort of ham-fisted wokery it points to a serious problem with AI. If the creators of AI applications insist that “responsible” AI means political control, censorship, fabrication, and bigotry, the usefulness of AI will be limited. Left unchecked, the wokery is likely to provoke restrictions and regulations aimed at preventing AI from forcing its leftwing views on its users. That could lead to a far lower demand for AI chips than is currently foreseen.

There’s also the uncomfortable exposure of the company to China. While it has reduced the share of data center sales to China, the company still depends on purchases from China. That may not be sustainable in the long term if China decides it does not want to be dependent on non-Chinese chips for AI or if the U.S. imposes further restrictions on sales to China. Or if both these things happen.

As You Like It: Nvidia’s Reflection on Monetary Policy

One broader implication of Nvidia’s quarterly results is that they add to the impression that the stance of monetary policy is not all that tight. The biggest companies are pouring an immense amount of investment into a developing technology, sending equities soaring. That’s a sign of accommodative policy rather than a restrictive one. At the very least, it suggests that the Fed should be in no hurry to cut rates in the near future.